-

"We started our collaboration with the BITSoftware team in 2007 and chose SocrateERP because we considered it a much better solution than the software used by all VW dealers at that time. Over time, Socrate has always provided us with a solution to every problem we encountered and has always provided us with support for timely filing of all mandatory declarations. We recommend SocrateERP because it is a reliable, robust, and highly configurable solution.

The year 2022 was full of changes in the tax system, especially due to the introduction of the mandatory filing of the SAF-T report and the electronic invoice (RO e-Factura). The SBS service Socrate-SAF-T has helped us a lot with the filing of declaration 406, and we couldn't have asked for more from SBS eFactura; everything is done with a single click.

Collaborating with the BITSoftware team has always been easy. We consider ourselves lucky to have people by our side who support us in every endeavor. We have always received support, understanding, and guidance from our implementation consultant.”

Andreea Ilie, Economic Director - Nurvil

-

What is SBS eSAFT?

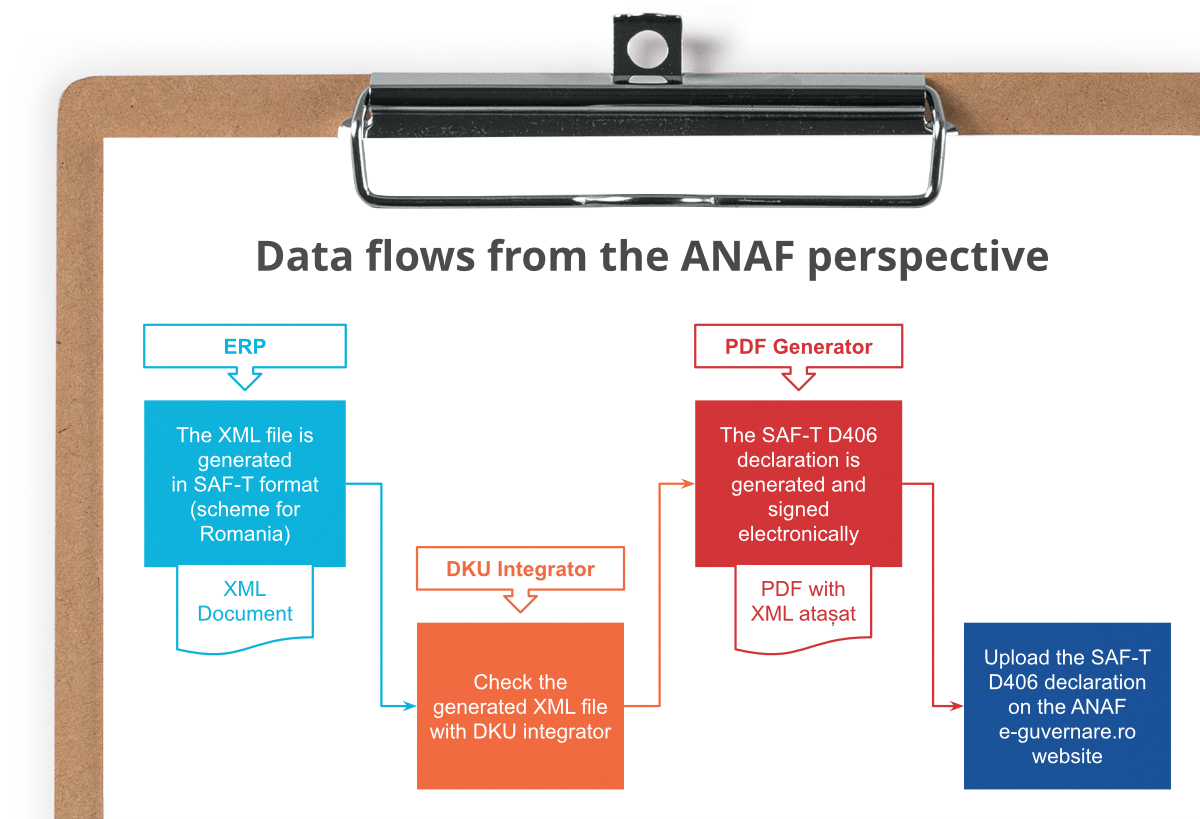

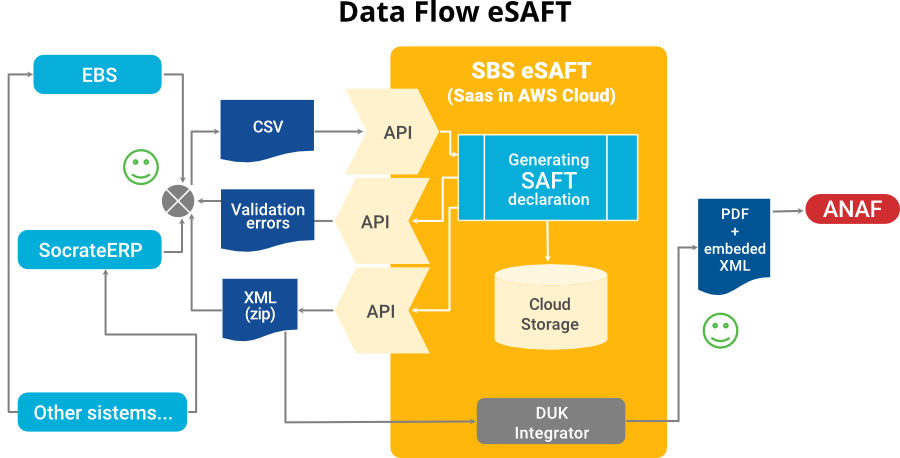

The application developed by BITSoftware for the mandatory SAF-T (Standard Audit File for Taxation) reporting to the National Fiscal Administration Agency (ANAF), takes into account all the necessary variables to be used by any company, regardless of its profile. The implementation is fast, and the solution is not strictly limited to the electronic transmission of data in the format required by ANAF, but covers the most difficult part of the reporting process, namely, retrieving the data required for reporting from the IT systems used by clients or from other csv standard formats.

SAF-T reporting consists of the electronic transfer of accounting and tax data, in a unified way, from companies to the tax administration. This reporting is currently only mandatory for large taxpayers, but soon the obligation will be extended to all taxpayers.

-

SBS eSAFT automates the SAF-T report for any company

Electronic exchange of accounting data has never been easier. The SBS eSAFT service significantly reduces the cost and complexity of the processes of generating, mapping and processing accounting information from the ERP application to convert it into the required XML file.

With the help of the SBS eSAFT service, all the preliminary steps are performed directly in SocrateERP, before the validation of the XML file via DUK Integrator and before it is uploaded to the portal of the tax authorities.

1. Collecting data required for reporting

CDirectly from SocrateERP or other sources with a simple click2. Processing the data

It processes the data to accurately adapt to the format required by the tax authorities3. Validating the data

It checks and validates data integrity and identifies potential errors so they can be corrected4. Generating the XML file

It automatically transforms the data into the XML file you need5. Archiving XML and CSV files

It automatically archives the data, both the CSV source and the XML declaration

-

SAF-T is an international tax reporting standard developed by the Organization for Economic Cooperation and Development (OECD), which has become mandatory in Romania since 2022, which regulates the electronic exchange of accounting data between organizations and tax authorities.

D406 Report (SAF-T) involves the generation of an internationally standardized XML file for companies' tax and VAT reporting.